The launch of battery cell production in Salzgitter marks the beginning of a new era for the German car giant and, implicitly, for the European industry. Under the auspices of the PowerCo division, Volkswagen is no longer just a car manufacturer, but is becoming a vertically integrated player, capable of producing its own technological "fuel".

Here is a detailed analysis of this event and how Romania could fit into the group's future plans.

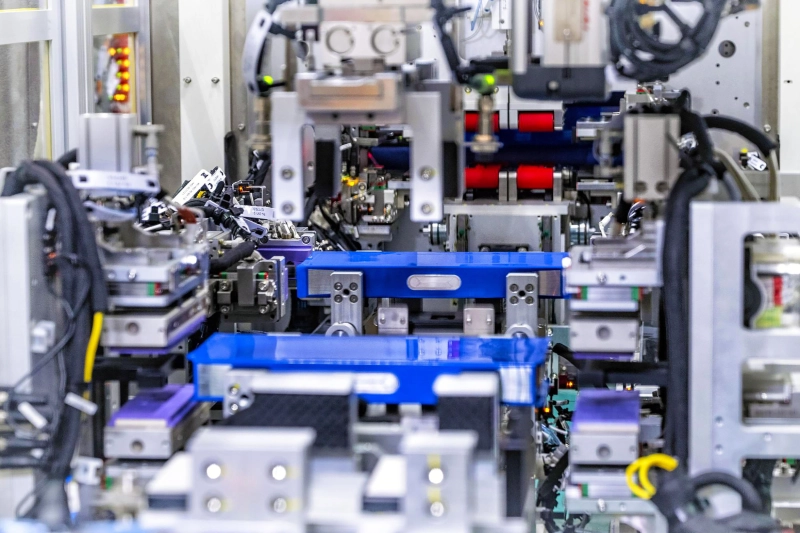

In December 2025, Volkswagen reached a historic milestone: the start of production of "Unified Cell" battery cells at the Salzgitter plant. This is the first in a series of gigafactories that will ensure the group's technological independence from Asian suppliers.

Key figures from the Salzgitter plant:

Total investment: Over 20 billion euros in the entire PowerCo ecosystem.

Initial capacity: 20 GWh, enough for approximately 250,000 electric vehicles per year.

Expansion potential: Plans call for doubling capacity to 40 GWh.

Technology: Produces the unified prismatic cell, which can use various chemical compositions (NMC for performance or LFP for low cost).

The plant runs exclusively on renewable energy, setting a new sustainability standard for heavy industry in Europe.

Volkswagen's initial strategy aimed to build six gigafactories in Europe by 2030. So far, the map is partially outlined:

Salzgitter (Germany) – Operational (December 2025).

Valencia (Spain) – Under construction, with production expected to start in 2026.

St. Thomas (Canada) – First foray into North America.

For the remaining three European locations, Volkswagen has taken a more cautious approach recently, conditioning investments on the evolution of demand in the electric vehicle (EV) market. However, competition between European states to attract these investments remains fierce.

The question hanging over the local auto industry is: Can Romania convince Volkswagen? Although in the past Hungary, the Czech Republic and Poland were the favorites for battery investments, the current context offers Romania some new strategic advantages, but also major challenges.

Romania's strengths:

Auto Tradition: With Dacia and Ford Otosan, Romania has a qualified workforce and a supplier chain already integrated into the European network.

Green Energy: Romania has a diversified energy mix and huge potential in wind and solar energy, an elimination criterion for PowerCo, which seeks a zero carbon footprint.

Operational Costs: Labor costs remain competitive compared to Central Europe, where the labor market is already saturated with other battery factories (such as those in Hungary).

Obstacles to overcome:

Infrastructure: The transportation of batteries (heavy and considered dangerous goods) requires an impeccable rail and road network, a chapter in which Romania is still recovering.

Regional competition: Poland and Hungary already have mature battery ecosystems (LG, SK On, CATL), which makes them "safer" targets for large manufacturers.

Government incentives: Such an investment requires massive state aid schemes and long-term fiscal stability.

Verdict: Although the Czech Republic and Poland are frequently mentioned as favorites for the Eastern European location due to their proximity to the group's assembly plants (Skoda, VW Poland), Romania remains a viable "back-up" option or for upstream components (raw material processing or recycling), especially if it manages to accelerate energy infrastructure projects.

Volkswagen is now monitoring the performance of the first cells produced in Salzgitter, which will be tested on models in the Electric Urban family (Skoda, Cupra and VW ID. Polo). The result of these tests and the stability of the automotive market in 2026 will decide whether Romania will officially enter the PowerCo short map.